It is an important function for a business as it makes it very clear how the business should manage its expenses or commitments to ensure its resources are efficiently managed. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. A copy of 11 Financial’s current written disclosure statement discussing 11 Financial’s business operations, services, and fees is available at the SEC’s investment adviser public information website – or from 11 Financial upon written request. Going concern value is a value that assumes the company will remain in business indefinitely and continue to be profitable.

Going Concern Concept Explained in Video

The standard said on a yearly basis, at the time of preparing Financial Statements, if those Financial Statements are prepared based on IFRS, management is responsible for assessing the Going Concern of their company. If the entity’s Financial Statements are prepared in accordance with IFRS, the standard dealing with going concerned is IAS 1. The standard requires the Financial Statements to properly disclose the basis of preparation of Financial Statements.

The Future of AI Is Now. Is Tax Ready?

- Paragraph A3 of ISA 570 provides good examples of financial, operational and other indicators which may individually or collectively cast significant doubt on the entity’s ability to carry on as a going concern.

- If there’s significant evidence that a privately held business might not be viable under the going concern assumption, the auditor must disclose it in the audit report.

- It is probable that management will obtain new sources of financing that will enable the Company to meet its obligations for the twelve-month period from the date the financial statements are available to be issued.

- The concept of going concern states that all records are made on the assumption that the business will continue for the foreseeable future.

Management should reassess the availability of financing because it may not be easily replaced and the costs may be higher in the current circumstances. Auditors must be extra vigilant in relation to the audit of going concern matters, and should also remember the possible ethical implications of being involved in non-audit services relevant to going concern. Going concern is an area which should be front and centre of every audit and evidence must be challenged with the appropriate level of professional scepticism. In the exam it is important to remember that going concern is therefore not just something considered at a particular stage in the audit cycle, but should be an issue that permeates the whole performance and review of an audit. Performance Financial Statements Analysis is an important procedure in assessing the going concern. This analysis includes performing financial ratios analysis, as well as trend analysis.

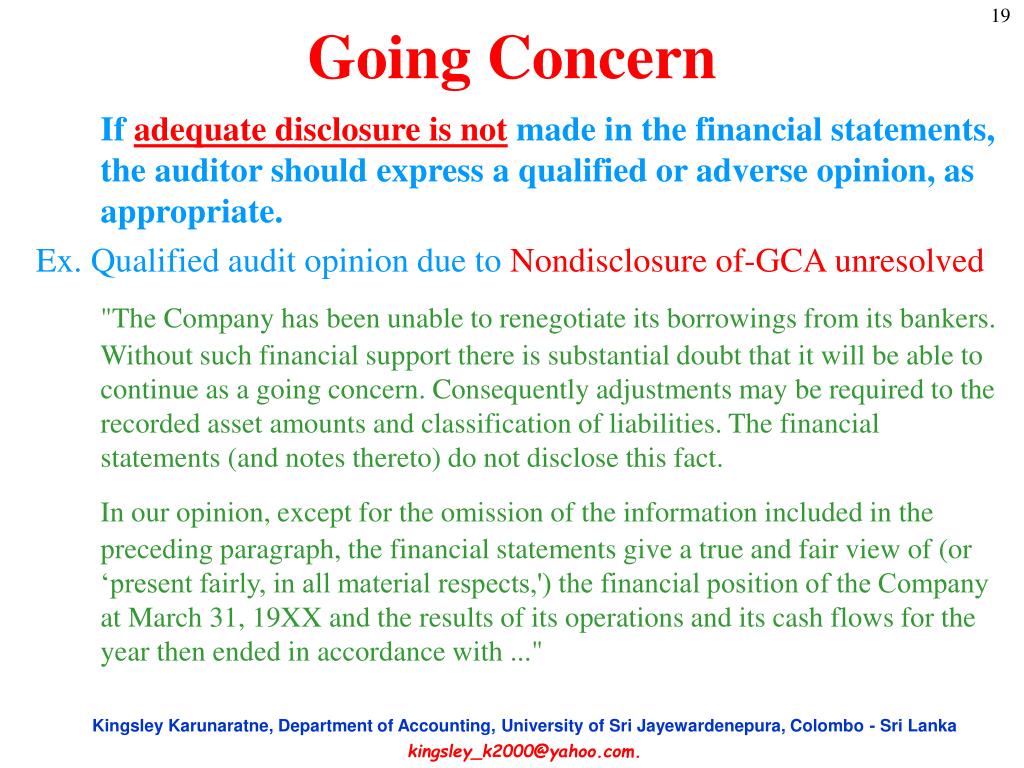

Opinion – Inadequate Going Concern Disclosures

Our IFRS Standards resources will help you to better understand the potential accounting and disclosure implications of COVID-19 for your company, and the actions management can take now. Under IFRS Standards, financial statements are prepared on a going concern basis, unless management intends or has no realistic alternative other than to liquidate the company or stop trading. Unlike US GAAP, there is no liquidation basis of accounting under IFRS; when a company determines it is no longer a going concern, it does not prepare financial statements on a going concern basis. However, in our view, there is no general dispensation from the measurement, recognition and disclosure requirements of the Standards in this case, and these requirements are applied in a manner appropriate to the circumstances. When management’s plans alleviate substantial doubt, companies need not use the words going concern or substantial doubt in the disclosures. And as Sears discovered, it may not be wise to do so (their shares dropped 16% after using the term substantial doubt even though management had plans to alleviate the risk).

The procedures to assess going concern

This is where a candidate explores all possible options rather than coming to a conclusion as to the auditor’s opinion, depending on the circumstances presented in the question. Many candidates fall into the trap of relying on ‘discussions with management/directors’ and ‘obtaining a written representation’. Candidates must appreciate that while discussion/inquiry is a valid audit procedure under ISA 500, Audit Evidence, such a procedure is always used in addition to other procedures – in other words, inquiry on its own will not generate sufficient appropriate audit evidence. Similarly ISA 580, Written Representations recognises that while written representations do provide necessary audit evidence, they do not provide sufficient appropriate audit evidence on their own about any of the matters with which they deal.

Why You Can Trust Finance Strategists

However, generally accepted auditing standards (GAAS) do instruct an auditor regarding the consideration of an entity’s ability to continue as a going concern. In order to avoid the entity’s credit rating suffering any further decline, the directors have refused to make disclosures in the financial statements and have prepared the financial statements for the year ended 31 March 20X2 on the going concern basis. Management typically develops plans to address going concern uncertainties – e.g. refinancing of debt, renegotiating breached covenants, and sale of assets to generate sufficient liquidity to continue to meet its obligations as they fall due. IFRS Standards do not prescribe how management should evaluate its plans to mitigate the effects of these events or conditions in the going concern assessment.

Under Step 1, management determines whether events and conditions raise substantial doubt about the company’s ability to continue as a going concern. If a company is not a going concern, that means there is risk the company may not survive the next 12 months. Management is required to disclose this fact and must provide the reasons why they may not be a going concern. Management must also identify the basis in which the financial statements are prepared and often disclose these financial reports with an audit report with a going concern opinion. It is important that management’s assessment considers different scenarios, including at least one severe but plausible downside scenario.

It is important for companies to consider not only traditional sources of financing but also other sources – e.g. supplier finance arrangements. The procedures are the key procedures and additional procedures might be required. Cash flow forecasting is also one of the most important procedures that we should use and perform to assess the going concern problem.

Assets would be recorded at net realizable values and all assets would be considered current assets rather than being segregated into current and long-term categories. Going concern is an accounting term used to identify whether a company is likely to survive the next year. Companies that are not a going concern may not have enough money to survive, and this fact must be publicly disclosed when an auditor audits their financial statements. A company may not be a going concern for a number of reasons, and management must disclose the reason why.

A financial auditor is hired by a business to evaluate whether its assessment of going concern is accurate. After conducting a thorough review (audit) of the business’s financials, the auditor will provide a report with their treasury stock financial accounting assessment. Management’s plans should be considered only if is it probable that they will be effectively implemented. Also, it must be probable that management’s plans will be effective in alleviating substantial doubt.